As such, bearer bonds were heavily used in various manipulation schemes and criminal activities. As with other fixed-income instruments, money raised by the issue of bearer bonds is used to fund the growth and operations of the enterprises or government. The coupons submitted to an agent or banker are bearer bonds value acknowledged immediately, and payment is made. Stocks and bonds are no longer issued in bearer form by corporations or governments in the U.S. These are unregistered securities whose ownership is proven only by their possession. Once popular, their vulnerability to theft or loss rendered them archaic.

Why You Should Start Investing Right Now

Because bearer bonds have no registered owner, there’s no record of who purchases the bonds, if or when they are sold, and who collects interest payments. The cash value of the old financial instrument was worth $250,000. The announcement asked people to connect with the authorities to claim for before it was disposed of because of being unclaimed by its bearer or holder. Typical bonds consist of semi-annual payments costing $25 per coupon. The yield the coupon bond pays on the date of its issuance is called the coupon rate. Bonds with higher coupon rates are more attractive for investors since they provide higher yields.

MANAGING YOUR MONEY

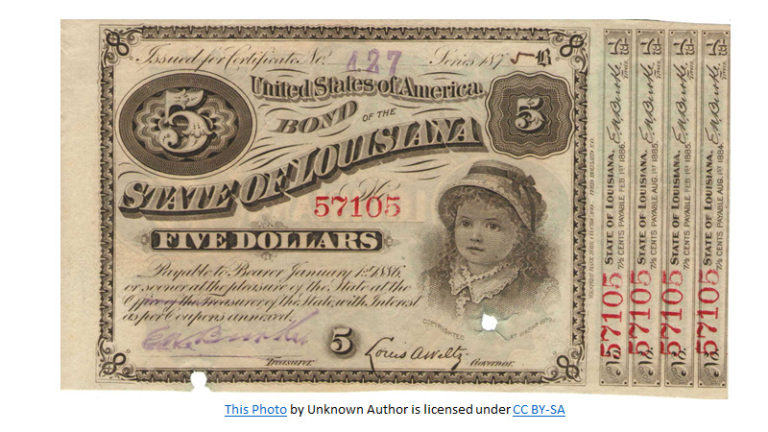

In contrast, registered bonds have a registered owner, and ownership changes are recorded, providing more security and traceability than bearer bonds. If the bond has reached its full maturity, this is the value of your bond. Many countries and businesses issue bearer bonds, so the values and dates may not be written in English. Bearer bonds are sometimes called coupon bonds because they include coupons redeemable for interest payments at regular intervals. A bond with unexpired, unredeemed coupons attached has not yet reached its full maturity. Most owners of bearer bonds keep the physical certificates in a safe deposit box at a bank or in a safe at home.

What Is a Coupon Bond?

This means that if the bond is stolen the person who holds it can cash it in without proof of ownership. It was also impossible for the Internal Revenue Service to track income from such unregistered instruments, which is the backbone of tax collection. In the U.S., bearer bonds were issued by the federal government or corporations from the late 19th century until the end of the 20th century. The bonds gradually lost their popularity and were replaced by newer investment vehicles and modern technology. Eventually, bearer bonds were outlawed by various governments in an effort to halt money laundering.

Are You Retirement Ready?

Initially, the allure of anonymity and ease of transfer made these instruments highly sought after by a diverse range of investors. High-net-worth individuals, corporations, and even governments found bearer bonds to be a convenient way to manage and move large sums of money discreetly. This demand was further fueled by the relatively high liquidity of bearer bonds, which could be quickly sold or transferred without the need for extensive documentation or approval processes. A bearer bond is a type of fixed-income security belonging to whoever physically holds it, and not to any registered owner. The bond contains coupons for interest payments; however, to collect an interest payment, the holder has to present the coupon at a bank or government treasury.

Security Issues With Bearer Bonds

- For those interested in investing with greater security and fixed income, Compound Real Estate Bonds offer a compelling alternative.

- Bearer bonds always held the potential for fraud and abuse, but it took a significant incident for legislation to be enacted that would eliminate the financial tool due to the anonymity of holders.

- He graduated from Georgia Tech with a Bachelor of Mechanical Engineering and received an MBA from Columbia University.

- The value of the bond will also be adjusted to the perceived risk that the issuer will remain solvent and continue to be able to pay the interest on the bonds.

International regulatory bodies have also played a role in shaping the landscape for bearer bonds. These guidelines have prompted many countries to implement stricter controls and reporting requirements for financial institutions dealing with bearer bonds. The global push for greater transparency and accountability has made it increasingly difficult for these instruments to thrive in modern financial markets. The market demand for bearer bonds has seen a dramatic shift over the decades, influenced by evolving financial landscapes and regulatory frameworks.

If you have old government-issued bearer bonds, you can redeem them at the U.S. You will need to send the government the bond certificate and coupons via insured mail and provide your address so they can send you a check. Bearer bonds were often used for tax evasion purposes, drawing the ire of governments around the world. By the early 1980s, many governments were taking steps to end the use of this investment type. These days, regulators want major investment sums registered and tracked. As the word went digital, bearer bonds quickly faded from relevance.

Bearer bonds have not been outlawed but rather have been rendered obsolete by regulations imposed in the European Union as well as the United States. Their benefits to the investor were outweighed by their vulnerability to loss or theft. Bearer bonds once promised complete anonymity to investors worldwide, but government crackdowns have made them virtually nonexistent in the U.S. You can read more about our commitment to accuracy, fairness and transparency in our editorial guidelines. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

They have coupon payments physically attached to the bond certificate itself. To collect the interest payments, the bondholder must clip the coupons and send them to the bond issuer for payment. The bond can be presented to the issuer at its maturity date for full redemption to receive the face value of the bond. A bearer bond is a debt security that is not registered to a specific owner, allowing anyone in possession of the bond to claim ownership and receive interest payments.